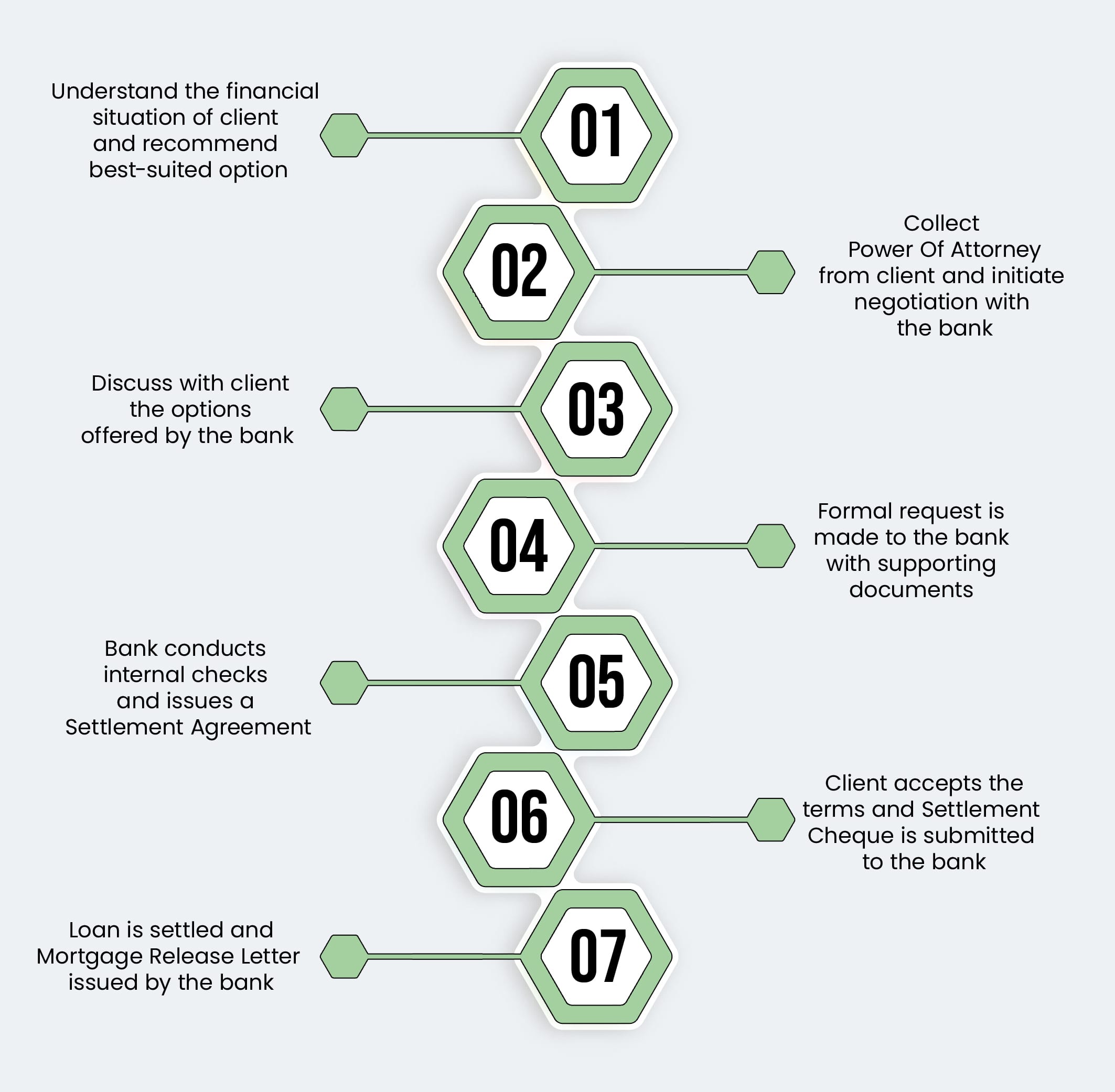

Process

The following process flow will give you a step-by-step insight into our professional Mortgage Debt Management service. At each stage, we provide key inputs, help you with the required paperwork, and represent you from start to finish with banks and developers until the closure of your mortgage loan

FAQs

The challenging market condition has resulted in a drastic shift from seller to buyer market, leading to depressed sale prices and rentals. This is also combined with the economic slowdown hindering cash flows and leading to salary delays and retrenchments. Being delinquent on your liabilities may have social and legal implications. Debt management helps you organise finances and alleviate such a situation.

Banks will contact you over the telephone for collection of overdue instalments. They would use all means including presenting the signed security cheque. In case you flee the country, they will give the account to external collection agencies to visit your home country to collect the amount. Traditionally, banks follow two options –

1. File a criminal case and ask the court to decide on imprisonment or fine as stipulated in the relevant jurisdiction.

2. Initiate civil case by requesting a travel ban on the individual and foreclosure of the mortgaged property. Post-judgment, the property is sold via auction.

The borrower is still liable to pay the shortfall to incase the sale price does not cover the loan outstanding. The travel ban continues to remains active until a settlement is concluded with the bank.

In case you wish to apply for settlement, the documents required would include a memorandum comprising of your financial position and all data related to your source of income. Your debt details, list of movable and immovable assets, all outgoing expenses with corresponding proofs, and a proposal to settle the debts. You can even hire a debt management specialist like FREED Financial Services to represent you.

Borrowers who fail to manage overdue claims often prefer fleeing the country, fearing criminal prosecution. They do not have the time or understanding of the bank’s requirements to approach them for solutions. FREED Financial Services represents such mortgage customers and provides end-to-end solutions to moderate or eliminate their liabilities.

A highly-qualified team of consultants will evaluate your financial situation and after an in-depth analysis, we customise options such as Debt Settlement or Debt Restructuring. We negotiate with the bank and assist in structuring a solution to close or moderate the mortgage liability without resorting to any legal procedure. You will be required to provide a Power of Attorney to FREED Financial Services LLC (drafted by us on your behalf) authorising us to represent you with the banks and other organisations involved.

FREED Financial Services is abreast of the real estate market, mortgage business, process and risks. We represent you from start to finish with banks and developers until the closure of your mortgage loan. We assure you that we will get you a fair solution from your bank.

We assess the borrower’s cash flow situation and prepare a proposal for the bank to moderate the liability. By using measures such as re-ageing and restructures, we work out different options such as repayment date extension at lower interest rates, step-up option to reduce the monthly instalment payment

We assist in analysing the market value of the property, sell the property, and negotiate the best possible settlement which would be a win-win for the bank and the customer. The Settlement Plan includes options like reduced repayment sum, flexible payment on shortfall – single or multiple at a lower rate of interest.

If the borrower has invested in a property that’s delayed or cancelled, he still needs to makes interest-only payments to the bank. In case you do not know what your options are, we conduct meetings with the developer to understand the status of the project and negotiate options such as refund or swapping. Thereafter, we negotiate with the bank and create an ideal settlement plan to foreclose the loan.

1. Existing mortgage customers facing difficulty in making payments due to inferior rents, reduced salaries, job loss, project delay, high Debt Burden Ratio (DBR) with a negative loan to value asset.

2. Borrowers who have left the country with the fear of criminal action if the loan is not settled.

3. Customers who have invested in properties that have been cancelled or delayed, and are making monthly interest payments to the bank and do not understand their options.

FREED Financial Services will not charge you unless you have benefited from the service. Our fees are based on the financial benefit gained.

If we succeed in negotiating with the bank, which results in a beneficial end result then will you are required to pay a fee. We generally work on You win – You pay strategy.

Get in touch